| Tweet |  |  |

Last Week: Must Know

Last week was a big one. While the S&P 500 and Dow Jones Industrial Average rose to all-time highs (again), this time it was data focused.

Data provided, Yahoo! Finance, Charles Schwab optionsXpress

Read: 3 Simple Charts That Explain the Bull Market

The job numbers were simply huge and the unemployment rate dropped to 6.1%. Here's a chart, then some commentary.

Data provided by Trading Economics

---

United States added 288,000 jobs in June, up from 224,000 in the previous month. Over the past 3 months, job growth has averaged 272,000 per month. Employment growth was widespread [].

Source: Trading Economics

---

Not only did that 288K number blow passed the 212K estimate, but the May number was revised up from 282K to 304K.

And better news...

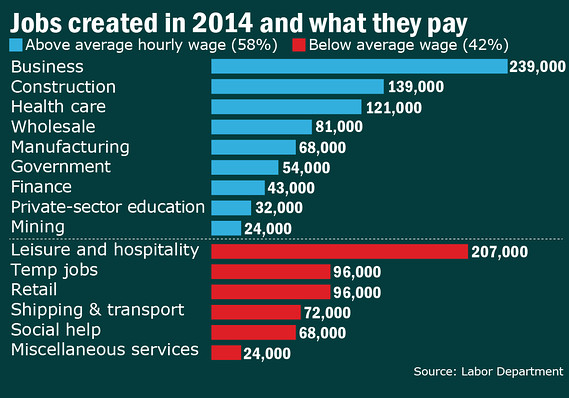

More than half of 2014′s new jobs pay higher than average wage

Data provided by MarketWatch

That is a stark difference from what we had seen up until this year, where wages and wealth were lower for 90% of the American Population.

We can see in the chart above that the bull market has in fact been the greatest wealth redistribution vehicle ever. The bull market has created huge wealth for the the top 10%, 1% and even the top 0.1% while 90% of Americans ("the rest") are worse off.

But the data for 2014 with respect to wages may be a turning point.

Last Week: Phenomena We Must Know

6-26-2014

Americans are Not Participating in the Economic Recovery.

7-3-2014

Is China a State Backed Accounting Fraud?

7-5-2014

Three Simple Charts That Tell Us... Everything

Last Week: Stats Must Know

Momentum remains very high after it re-entered the market several weeks ago.

* As of Friday: 79.6% of stocks are now trading above their 50-day MA

* As of 1-month Ago: 60.91% of stocks were trading above their 50-day MA

* As of 6-weeks Ago: 40.8% of stocks were trading above their 50-day MA

Provided by BarChart.com

A little perspective is needed given those enormous gains in momentum, and here it is. a one-year chart of the percentage of companies trading above their 50 day moving average.

Provided by BarChart.com

Yep... just at that annual high (80%) hit in August of last year.

Last Week: Must Know Headlines:

* More than half of 2014′s new jobs pay higher than average wage

* Startling news for investors, Yellen and Congress

* The real reason Americans are disgusted with government

* For most families, wealth has vanished

This Week: Must Know

This week is rather light on the economic calendar, although we must note that the United States Federal Reserve and the European Central Bank may be moving in opposite directions. While the US is cutting QE and eying rate hikes in the relatively near future, the ECB is looking to begin QE and cut rates last month.

One caveat is the UK where a housing bubble may be in effect with prices rising 26% year over year. Expectations are for a rate hike in the UK soon, perhaps before year end.

Below you will find all that we need to prepare for the week to come

All data and images for this report are provided by Charles Schwab optionsXpress

This Week: Economic Calendar

Partial List of Noteworthy Earnings This Week

The 15 most optionable earnings events; a relatively quiet week as we have moved well out of earnings season. Here's a list of tradable (liquid) earnings events.

This is trade analysis, not a recommendation.

Follow @OphirGottlieb

Tweet

Legal Stuff:

Options involve risk. Prior to buying or selling an option, an investor must receive a copy of Characteristics and Risks of Standardized Options. Investors need a broker to trade options, and must meet suitability requirements.

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. I am not engaged in rendering any legal or professional services by placing these general informational materials on this website.

I specifically disclaim any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

I make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that I endorse, sponsor, promote or am affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

No comments:

Post a Comment