| Tweet |  |  |

Update 8-11-2014

U.S. jobs rose since 2008 crisis, but pay is 23 percent less

This is a difficult article for me to write. Not because the facts are hard to find, on the contrary, the data is abundantly available. In fact, I'll share all of my sources with you and you can do your own further investigation.

Here's a primary one:

The World Top Incomes Database

This is difficult for me to write, because most people don't want to read it. I'll be able to prove it with traffic numbers. An article on TWTR, NFLX, TSLA, GOGO, PLUG, whatever... that gets readership, re-tweets, comments. But here's the thing:

Conclusion

The vast majority of the US population is not participating in this economic recovery -- in wages or capital gains and it's affecting consumption, rent, income and quality of life.

Companies are (1) paying lower wages, (2) getting higher productivity from employees, (3) taking the extra (all-time high) profits to buy back their own stock and increasing their compensation (incentive based comp).

While politicians would love to engage you in a story of wealth re-distribution with respect to taxes or ACA, they shy away from the greatest wealth re-distribution event ever: This bull market.

"In 2003, the top 20% Americans had 13 times more wealth than the median household. By 2013, this gap nearly doubled to 24 times."

Source: Double the wealth gap? Double the pleasure (for heirs): The Excess Files

The consumer, the 99%, the guy, the girl, the you, the me, we're not participating in the economic recovery with respect to wages or the stock market, but the extent of it has been hidden -- perhaps not by nefarious means, perhaps simply because:

No one wants to read it, no one wants to know it, and no one wants to believe it.

And why would we... It's terrible...

I'm covering just the high level... mostly because going further is a never ending practice in shock and awe (pun intended).

The facts below come from the IRS, the US Federal Reserve, the U.S. Dept. of Labor & the U.S. Bureau of Economic Analysis.

Fact #1: Data from IRS tax filings show from 2009 to 2012 (the most recent years for which data are available) average incomes of America’s top 1 percent grew 31 percent, while average incomes of the bottom 90 percent shrank by almost 2 percent.

Here is a chart comparing average income of the top 10% to the rest (90%), indexing 2009 as 100:

Source: The Internal Revenue Service

Even more startling than the data above, as the recovery has moved forward, the share of total income owned by the top 1% and even the top 0.1% has exploded as 90% are worse off.

Source: The Internal Revenue Service

Fact #2: There is a strong linear relationship between the returns of the stock market and the abrupt rise in income for the top 10%, 1% and even more abruptly, the top 0.1%.

The chart below now gets to the crux of the issue, when we add the S&P 500 (right-hand side axis).

It's not really the top 10%, but the top 1% and top 0.1% that are reaping all the rewards from the bull market.

Source: The Internal Revenue Service

Same chart with comments added

Source: The Internal Revenue Service

Note that the abrupt rise in incomes for the top 1% and 0.1% correlate with the rise in the stock market. The bottom 90% see no correlation (actually a negative correlation) to stock market returns. When we read pundits, press, whomever, write "the retail public isn't participating in the bull market," they're right. But someone sure is.

Fact #3

(a) For the top 0.1% of income earners, 34% of that income is driven by capital gains.

(b) For the top 10% of income earners, that number drops to 11% .

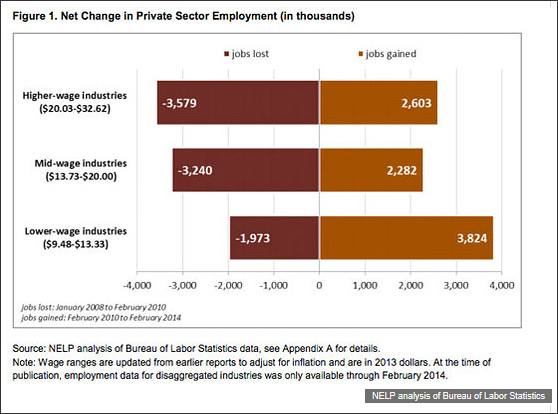

Fact #4: Lower-wage industries accounted for 22% of job losses during the recession but 44% of employment growth over the past four years.

That is an astonishing chart and set of numbers, and lead to this quote:

"Deep into the recovery, job growth is still heavily concentrated in lower-wage industries"

Source: National Employment Law Project

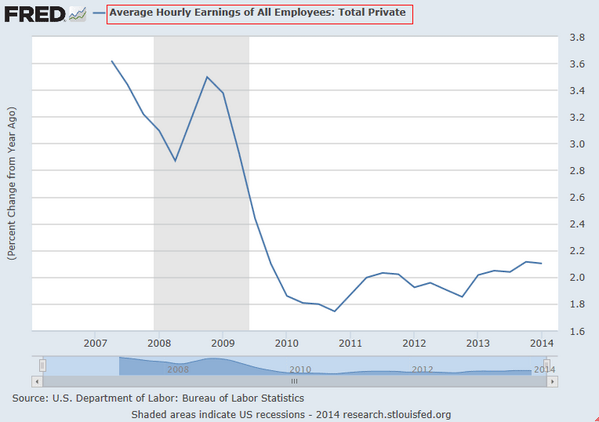

Fact #5: Wage growth has stagnated.

Source: The US Federal Reserve

Fact #6: Wages as a percentage of GDP are dropping dramatically:

Source: The US Federal Reserve

Fact #7: Median household income was $50,017 in 2012, below 2007's peak level of $55,627, after adjusting for inflation.

Source: U.S. Census Bureau data.

Fact #8: The current expansion which has left the vast majority of the United States behind in total income and wage growth, is showing its effects on consumption. Namely, we are simply consuming less than in prior recoveries.

Source: U.S. Economic Growth Loses Traction

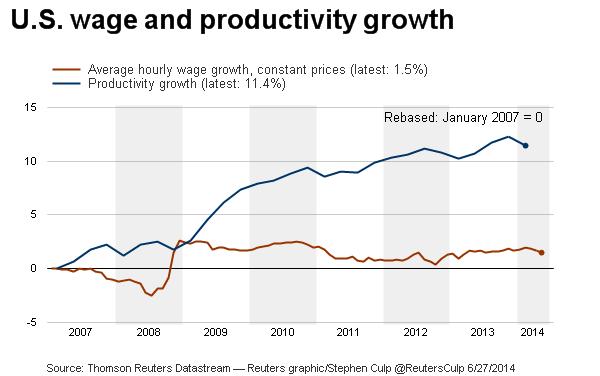

By the way, corporate profits are at all-time highs, because of your productivity.

Fact #9: Productivity is booming, wages... are not.

Source: Reuters

You're welcome corporations.

So where is this money going if not to wages?... To stock buybacks.

Fact #10: Since the peak of 2007, the quarterly stock buybacks $ are currently at new highs.

Provided by Zero Hedge

And do those buybacks affect stock prices?

Fact #11: The number of companies in the S&P 500 buying back stock are right at a decade high.

Provided by Factset

Yes, buybacks are catapulting stocks higher (especially as volume elsewhere is dwindling). You can read a detailed post on these phenomena here:

10 Facts that May Rock Your World: Has the Last Year Been an Artificially Driven Stock Rally?

So what's really happening?

Companies are paying lower wages, getting higher productivity from employees, taking the extra (all-time high) profits, buying back their own stock and increasing their compensation (incentive based comp).

Why is this tolerated?

I'm reminded of a parable:

-----------

"A 60-year old man had three square meals a day for his entire life. He was always satisfied and full.

On his 61st birthday, a famine hit. For that year he scoured the Earth to find even one meal every other day... nearly starving to death. On the precipice of starvation the famine finally ended.

Although the situation improved, things never went back to normal. He lived in a world where he was now finding two square meals a day.

As time passed, he grew to be thankful for the two meals, remembering so vividly the horrific days of near starvation. He considered it the "new normal." He grew to be almost full and almost satisfied all the time, until the day he finally died of old age."

-----------

Are you full? Are you satisfied? Do you accept this "new normal?"

Me either.

Fact #12: "Household incomes have stagnated, resulting in a financial squeeze for a growing number of renters."

Source: Apartment Rents Rise as Incomes Stagnate

This is trade analysis, not a recommendation.

Follow @OphirGottlieb

Tweet

Legal Stuff:

Options involve risk. Prior to buying or selling an option, an investor must receive a copy of Characteristics and Risks of Standardized Options. Investors need a broker to trade options, and must meet suitability requirements.

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. I am not engaged in rendering any legal or professional services by placing these general informational materials on this website.

I specifically disclaim any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

I make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that I endorse, sponsor, promote or am affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Do you think some of the 1% and even 0.1% are transitory? For example, a small business owner sells his/her business triggering a big capital gain in one year but then drops out of this rarified air?

ReplyDeleteYou have to consider long term yearly income not a couple of years of big money(unless those years are say 10mil+) obviously $: but where or is there a"tipping"point? when frustation over these inequalities in wealth create a treacherous environment for the 1% or do"they" know how to keep the 99% at bay with enuogh tv,drugs, sports,pop cultr,gadgets, bobles and cheap food

DeleteFrom what I see, the divergence in wealth is increasing, which points to something more permanent than a transitory wealth gain.

Delete