Note the original publication date: Saturday, May 3, 2014

When Headlines Aren't Enough.

*Jobs *Wages *GDP * Housing *Winter *ACA *QE *This Recovery is Different

-------------------- Jobs: Numbers --------------------

1. Fact: The U.S. added 288,000 jobs in April, the biggest spike since January 2012.

2. Fact: The 288,000 new jobs in April is the second largest in 32 years.

3. Fact: U.S. unemployment rate fell to 6.3%, the lowest level since 2008.

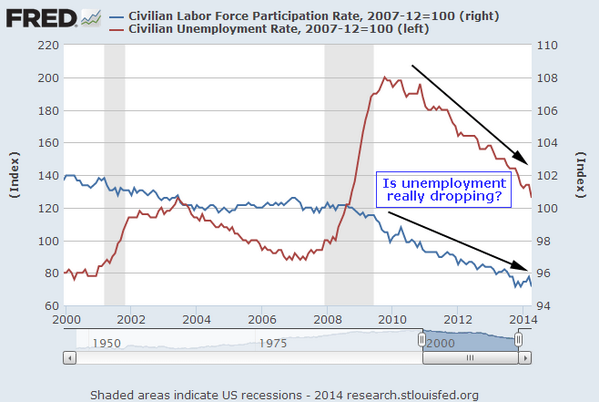

4. Fact: The size of the labor force shrank by 806,000.

5. Fact: The labor force size shrinkage is the second biggest drop in 32 years.

6. Fact: The largest labor force shrinkage came in October of 2013 (848,000).

7. Fact: The number of "re-entrants" – unemployed workers who have started looking for jobs again – fell by 417,000. That’s the biggest drop since the government began keeping records in 1967.

8. Fact: New entrants into the labor force fell by 126,000; the biggest decline in more than five years.

9. Fact: The drop in April to 62.8% from 63.2% – drove the participation rate back down to a post-recession bottom and matched a 35-year low.

Source: MarketWatch

Conclusion: More jobs are being created but the number of people dropping out of the labor force is literally unprecedented. Note: The US population is growing so nominal comparisons over time do have short comings.

-------------------- Jobs: Wages/Quality --------------------

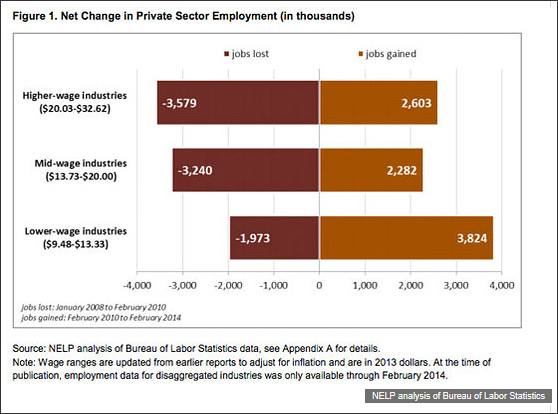

10. Fact: A majority of the new jobs created in the four years of the recovery have been in low-wage sectors.

11. Fact: Lower-wage industries accounted for 22% of job losses during the recession but 44% of employment growth over the past four years.

--- Opinion: That is an incredible disparity. Read that last fact again. ---

12. Fact: Higher-wage industries accounted for 41% of job losses but 30% of the recent employment growth over the past four years.

Source: Most jobs created in this recovery are low-wage, study finds

“Deep into the recovery, job growth is still heavily concentrated in lower-wage industries”

National Employment Law Project, a progressive research group which has been pushing for Congress to increase the minimum wage.

Conclusion: The jobs that were created last month, and have been created over the last four years, are low quality, low wage jobs and differ significantly from the jobs that were lost in the 2008 recession.

-------------------- GDP Report & Housing --------------------

13. Fact: GDP grew by only 0.1% in the first quarter below already significantly reduced estimates of 1.2%.

Nasty GDP Report, written by By Mark Thornton.

13: Update 5-29-2014: GDP shrank 1.0% in Q1 per the "second estimate" from the U.S. Department of Commerce.

---

"Real gross domestic product -- decreased at an annual rate of 1.0 percent in the first quarter according to the "second" estimate released by the Bureau of Economic Analysis"

The decrease in real GDP in the first quarter primarily reflected negative contributions from

private inventory investment, exports, nonresidential fixed investment, state and local government

spending, and residential fixed investment that were partly offset by a positive contribution from

personal consumption expenditures.

---

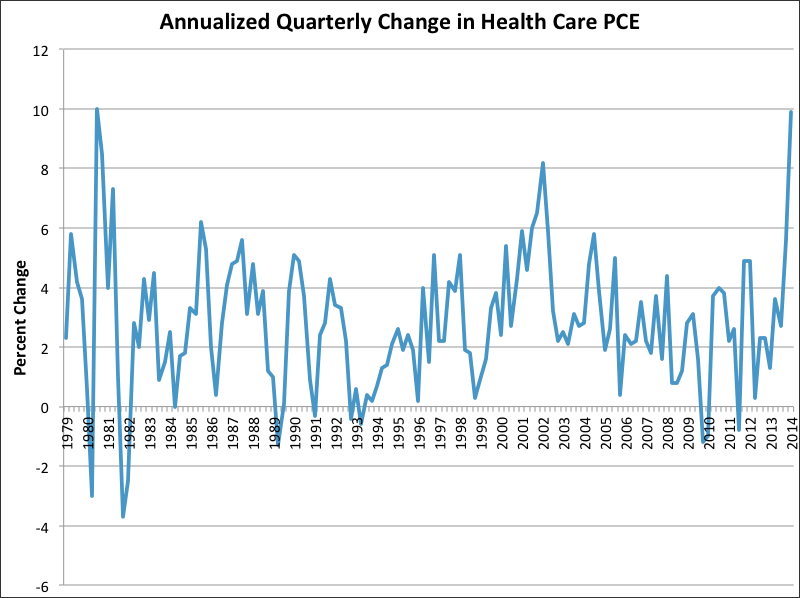

14. Fact: Without the increase in health-care spending (ACA), GDP would have been -1.0% (negative) for Q1.

15. Fact: Housing cut economic growth in the first quarter, following a drop at the end of last year, for the sector’s first back-to-back subtraction since the first half of 2009.

16. Fact: Recent housing data have been so disappointing that FNMA and Freddie Mac both recently cut their forecasts for the market’s performance in 2014. (Source: MarketWatch, written by Ruth Mantell.)

17. Fact: The winter was brutal on all parts of the economy and had a significant negative impact on growth.

18. Fact: Consumption grew at a 3% rate but the consumption rate was largely driven by a nearly 10% jump in health care spending.

19. Fact: Health-care spending exploded by 9.9%, the largest number in over 30 years (1980).

BUSINESS INSIDER, written by Brett LoGiurato.

20. Fact: Adjusted for inflation, America is spending more on health care than ever before.

"If health-care spending had been unchanged, the headline GDP growth number would have been -1.0%," (Ian Shepherdson, chief economist for Pantheon Macroeconomics)

21. Fact: The saving rate is also reported to be “unusually low.”

22. Fact: There were large negative reversals in both exports and equipment purchases from the 4th quarter of last year.

23. Fact: The accumulation of inventories (though reduced) is still accumulating rapidly indicating less of a need to add inventory in future quarters.

Conclusion: If not for the effect of the Affordable Care Act (ACA), the US saw a 1.0% decline (-1.0% GDP growth) in GDP while the Fed has an annual target of +3.0% for 2014. The weather had an unexpected negative impact on GDP which is not necessarily a trend.

--- Opinion: Even without the weather, we may be headed into contraction. ---

Definition: Recession

A significant decline in activity across the economy, lasting longer than a few months. It is visible in industrial production, employment, real income and wholesale-retail trade. The technical indicator of a recession is two consecutive quarters of negative economic growth as measured by a country's gross domestic product (GDP); although the National Bureau of Economic Research (NBER) does not necessarily need to see this occur to call a recession.

Source: Investopedia

24. Fact: The current expansion is 58 months old.

25. Fact: The average expansion since 1857 lasted 42 months.

26. Fact: The average expansion in the postwar era is 59 months.

Opinion: Without the effect of ACA, we have just had our first quarter of GDP contraction.

-------------------- Quantitative Easing --------------------

27. Fact: In September of 2012, QE3 began.

28. Fact: QE3, entails buying $40 billion in mortgage-backed securities each month.

29. Fact: QE3 combined with Operation Twist added $85 billion in long-term bonds to the Fed's balance sheet each month.

30. Fact: In December of 2013, the Fed began unwinding QE3 by reducing its monthly asset purchases with $10 billion trimmed equally from mortgage-back securities (MBS) and Treasury bonds each month.

Chart: Effect of QE on the S&P 500

There are a lot of charts like this one online. I happened to re-draw this from scratch, but it seems to point to causality between QE and stock returns. I would caution that the conclusion may be in error. But, I equally caution that the conclusion may not be in error.

Conclusion: We don't know the impact that ending all QE will have on the market. We have heuristic data that may point to a negative impact.

-------------------- Why this Recovery is Different than the Rest --------------------

31. Fact: Compared to the prior three U.S. expansions, going back to 1982, the economy is recovering at merely 60% of that pace.

32. Fact: The economic expansion following the 2008 recession has been the weakest of the post–World War II era.

33. Fact: As of 11-19-2013, home prices remain lower than they were at the start of the recovery.

(this seems unbelievable -- triple check this one).

34. Fact: At this point in past recoveries, the economy expanded by an average of 19%, today, the U.S. economy has grown 11% overall since the June 2009 trough.

35. Fact: From 2009 to 2012, average incomes of America’s top 1 percent grew 31% while average incomes of the bottom 90% shrank by almost 2%.

--- Opinion: Of all the facts, this may be the most extraordinary. Read that last fact again. ---

Conclusion: The expansion and / or economic growth has literally not been felt by the bottom 90%. In fact, they are worse off than the recession period with respect to wages. Of course, there are more jobs as well.

Source(s):

U.S. Economic Growth Loses Traction

The U.S. Economic Recovery in Historical Context, written by Dinah Walker (updated 11-19-2013)

This is not a recommendation.

Follow @OphirGottlieb

Tweet

Legal Stuff:

Options involve risk. Prior to buying or selling an option, an investor must receive a copy of Characteristics and Risks of Standardized Options. Investors need a broker to trade options, and must meet suitability requirements.

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. I am not engaged in rendering any legal or professional services by placing these general informational materials on this website.

I specifically disclaim any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

I make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that I endorse, sponsor, promote or am affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Yup, yet 90 million+ condos in NYC are flying off the shelf. http://www.huffingtonpost.com/2012/05/18/one57-penthouse-sold-for-_n_1527360.html

ReplyDelete