| Tweet |  |  |

This note follows several years and asks a simple (yet complicated) question:

Is China a State Backed Accounting Fraud?

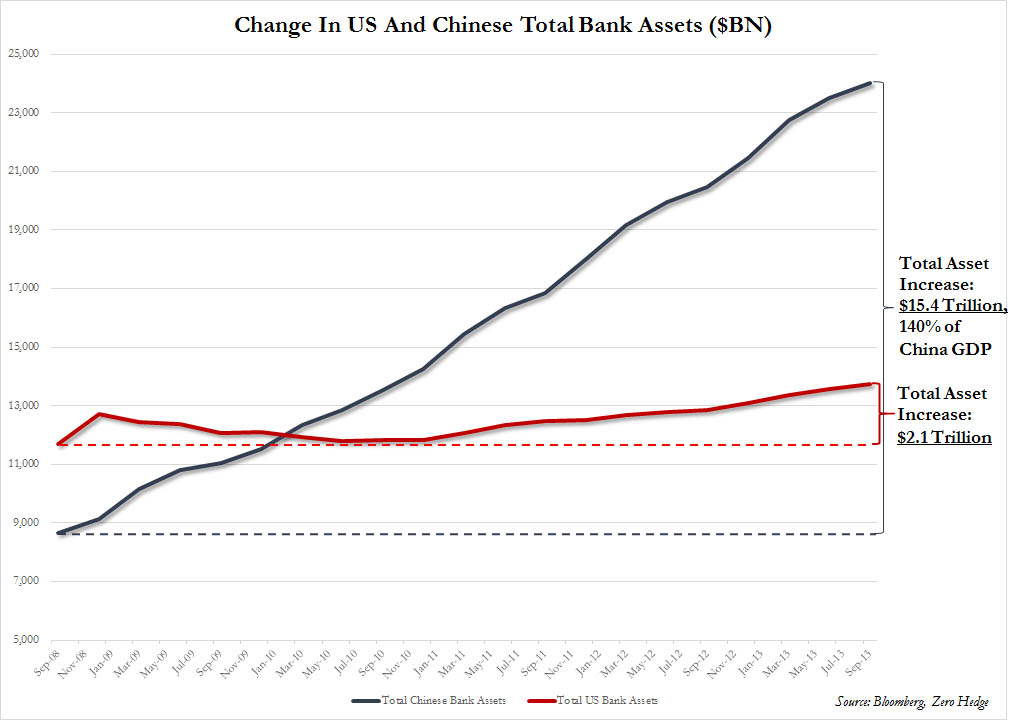

First a chart from ZeroHedge (Change in Total bank Assets)

Provided by Zerohedge

That number for China is now 2.5x GDP.

"Putting the rate of change in perspective, while the Fed was actively pumping $85 billion per month into US banks for a total of $1 trillion each year, in just the trailing 12 months ended September 30, Chinese bank assets grew by a mind-blowing $3.6 trillion!"

Source: Global Research

A step back...

I think we have all been tracking the disturbingly high number of frauds (or fraud accusations) for Chinese firms trading as ADRs on US exchanges.

Here's an article I posted on Sep 29th, 2011:

Is China A State Backed Accounting Fraud Epidemic?

But this goes even further.

5-26-2011: The Audacity of Chinese Frauds (WSJ)

and...

9-29-2011: Chinese Stocks Crushed on Report of DOJ Probe (WSJ)

And yet further... There have also been a disturbing number of frauds surrounding mainland China and the flavor of the month this time is metals. This is 2014:

---

Chinese authorities raised concerns about the use of gold to back loans, saying they had discovered billions of dollars of "improper" transactions, as companies exposed to a separate case of potential fraud involving copper- and aluminum-linked lending discussed a deal to share the possible losses.

Source: China Flags 'Improper' Gold-Backed Loans, written by Enda Curran, Sarah Kent and Chuin-Wei Yap.

---

The real question is, how much of the information coming from China is real? If it isn't real, is it little "fudges" that basically affect only the fringes, or is it "big f*ing deal" misrepresentation?

Is it truly government backed, or just a lack of controls?

Keep in mind, before we finger wag, the United States went through its own Fraud Epidemic in 2002: Enron, WorldCom, Tyco, Health South, Quest, Adelphia... need I go on?...

But, while the United States essentially got crushed with the fraud epidemic, China so far has not. In fact, economic data from China all of a sudden took a turn for the positive this month. Check this out:

---

China’s Purchasing Managers Index, or PMI hit a six month high on Tuesday to close the month of June at 51. It as 50.8 in May. The rise shows continued momentum in the Chinese economy.

On Monday, China’s President Xi Jinping warned the Communist Party not to be complacent with the reform agenda now that the economy is heading in the right direction. Investors have been watching for signs of progress as China slowly opens its economy to foreign investment and shifts gears from an export driven economy to a more domestic consumer focused one.

Source: Forbes China PMI Index Hits New Heights

---

But just six months ago we had this:

---

China's economy displayed clear signs of a slowdown in December, with a business survey of the service sector adding to recent pessimism—and showing that both manufacturing and services are weakening simultaneously for the first time in months.

Source: The Wall Street Journal Survey Indicates Worsening Economy

---

And three months ago we had: "China's economy grew at its slowest pace in 18 months at the start of 2014" as of April 16th, 2014." China economic growth slows to 18-month low in first-quarter via Reuters.

And four months ago we had: China Is Crashing. Credit Bubble, Financial and Industrial Bankruptcies, Debt and Bond Busts

Here are a bunch of headlines surrounding the entire issue and really point to the mass confusion:

5-26-2011: The Audacity of Chinese Frauds (WSJ)

9-29-2011: Chinese Stocks Crushed on Report of DOJ Probe (WSJ)

4-16-2014: China economic growth slows to 18-month low in first-quarter (Reuters)

3-8-2014: China Is Crashing. Credit Bubble, Financial and Industrial Bankruptcies, Debt and Bond Busts (Global Ressarch)

5-19-2014: Is China’s Housing Bubble Beginning to Burst? (Bloomberg)

6-26-2014: China Flags 'Improper' Gold-Backed Loans (WSJ)

7-1-2014: China PMI Index Hits New Heights (Forbes)

The thing is, opaque reporting and communication, whether it be by company or by country means one thing: Risk. But the world isn't pricing in risk right now... not for anything. In fact, we are in a whirlwind of risk malaise.

So is China in a bubble or not? Is China a fraud or not? Does any of it matter or not?

So far, for all the incredible data and very smart people that have provided the data, like this:

Has the Chinese Apocalypse Started? Is China on the Cusp of a Deflationary Vortex? where I source Gordon Chang.

The answer has simply been... 'No. None of this matters.'

And the second question: 'Will it ever matter?'

And the answer, in my opinion, 'yes, it will.'

Recommended reading: The "Miracle" Of China's PMI Resurrection In 1 Uncomfortable Chart via ZeroHedge.

This is trade analysis, not a recommendation.

Follow @OphirGottlieb

Tweet

Legal Stuff:

Options involve risk. Prior to buying or selling an option, an investor must receive a copy of Characteristics and Risks of Standardized Options. Investors need a broker to trade options, and must meet suitability requirements.

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. I am not engaged in rendering any legal or professional services by placing these general informational materials on this website.

I specifically disclaim any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

I make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that I endorse, sponsor, promote or am affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

No comments:

Post a Comment