| Tweet |  |

It's all about jobs this week.. well, that and the European Central bank (more on that below). Wednesday and especially Thursday & Friday may present market moving macro news. The data and positioning last week in the bull vs. bear camp were whiplash worthy. New all-time highs in the S&P 500 were reached yet the average volume in May was the lowest since April 2013. But then again, 2013 was a huge bull run, so in a certain sense, who cares?

GDP shrank in Q1, making it nearly impossible for the FED to reach its 3% growth rate goal for full year 2014. If not for the spending in healthcare due to ACA, Q1 GDP shrinkage was downright scary. But again, no one seemed to care... winters happen, laws happen, right?

The labor market participation rate is shrinking faster than ever before, making the unemployment rate 'artificially' low. But that's OK, baby-boomers are retiring, we know that, so of course participation is lower... right?

S&P 500 vs S&P to Russell 2000 Correlation (30-wk moving average)

Wages... Well, about 20% of the jobs lost in the last recession were from low paying jobs, yet 40% of new jobs created are in low wage sectors. That could be considered bad, but then again, nobody seems to care about that either. That is, if we consider "nobody" the stock market.

MOMOs rallied again, biotechs rallied again, but earnings were down. Winters happen.

The expectations for May are pretty big -- if those are not met, I don't think the winter argument will keep the market up. But, if, and it's a distinct possibility, the rebound in May is larger than expected, hey, that winter argument does hold water, and we will see new highs in the S&P 500 -- that's a promise. A promise based on an "if."

Further: "Investors are closely watching Europe this week, but it's not President Obama's European trip that is getting the most attention. The market is transfixed on what the European Central Bank (ECB) will decide at its policy-making meeting this Thursday, and that could be very dramatic."

Source: ECB rate cuts likely to have little impact on Europe's economy: Mark Dow

The ECB is expected to announce some dramatic Quantitative Easing (QE) of their own. But, the bar has been set so low for the slow moving and austere ECB, that "dramatic" could be relatively small compared to the US. Interestingly, as the ECB will likely announce QE, the US is ending QE. Hmm....

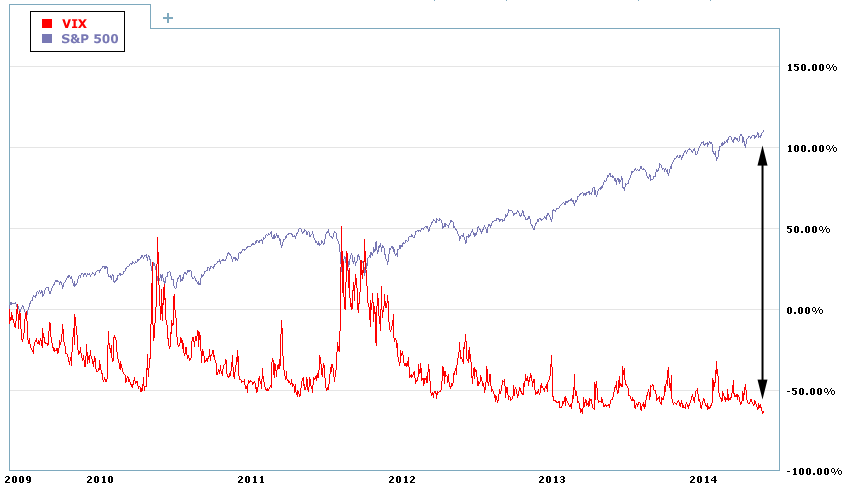

Having said all of that, how does an 11% VIX level sound? No risk here...?

All data and images for this report are provided by Charles Schwab optionsXpress

Economic Calendar

Partial List of Noteworthy Earnings This Week

The 15 most optionable earnings events; a relatively quiet week.

Technical / Pattern Breakouts to Watch: Up-trends

Note that five of the six names are repeats from last week (two of which are still China large cap ETFs). The Chinese ETFs outperformed the S&P 500 last week again.

Bubble, new bull market, or randomness?

S&P 500: +0.61%

---

FXI: +1.94%

XPP: +3.51%

Technical / Pattern Breakouts to Watch: Down-trends

Note MOMO favorites LNKD (repeat from last weak) and SKUL.

This is trade analysis, not a recommendation.

Follow @OphirGottlieb

Tweet

Legal Stuff:

Options involve risk. Prior to buying or selling an option, an investor must receive a copy of Characteristics and Risks of Standardized Options. Investors need a broker to trade options, and must meet suitability requirements.

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. I am not engaged in rendering any legal or professional services by placing these general informational materials on this website.

I specifically disclaim any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

I make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that I endorse, sponsor, promote or am affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

No comments:

Post a Comment