TWTR just released earnings and after hours the stock is trading at around $38.15 down from a close of $42.62. The Symbol Summary is included below.

Provided by Livevol

Note that I have highlighted the AH trades.

---------------

UPDATE 4-30-2014

Provided by Livevol

TWTR has in fact broken into a new all-time low.

---------------

This is a review of all the information that has come out thus far from the earnings release. First, with respect to stock price, I have included the all-time stock price for TWTR, below.

Provided by Livevol

We can see the meteoric rise and the equally abrupt fall in price. The all-time low for TWTR is $38.80 and for the moment (it's just a moment in AH), it is now trading below that all-time low.

Now, the earnings results:

- Average Active Users: 255M up 5.8% quarter-over-quarter and 25% Y-O-Y

- "Freshened" Timelines: 157 billion times up 15% from last year but below analyst estimates

- Revenue: $250M (up 119% from $114M a year ago) above estimates of $241.5M

- Ad Revenue per Thousand Timeline Views: $1.44 (nearly 2x last quarter).

- Ad Revenue: $226M up 125% from year ago

- Mobile Ad Revenue: 80% of total revenue

- Mobile Ad Market Share: Estimate 2.7% (up from 2.4%) vs FB 22% and GOOG 47%

- "Excluding Items" EPS: Even vs. expected -0.03 (loss)

- Net Loss: $135MM (up 5x from $27M a year ago)

Future:

Revenue Next Quarter: Company forecasts $272M; Wall St. estimates were [$270M, $280M]

Revenue for Full Year: Wall St. Estimates: $1.2B - $1.25B

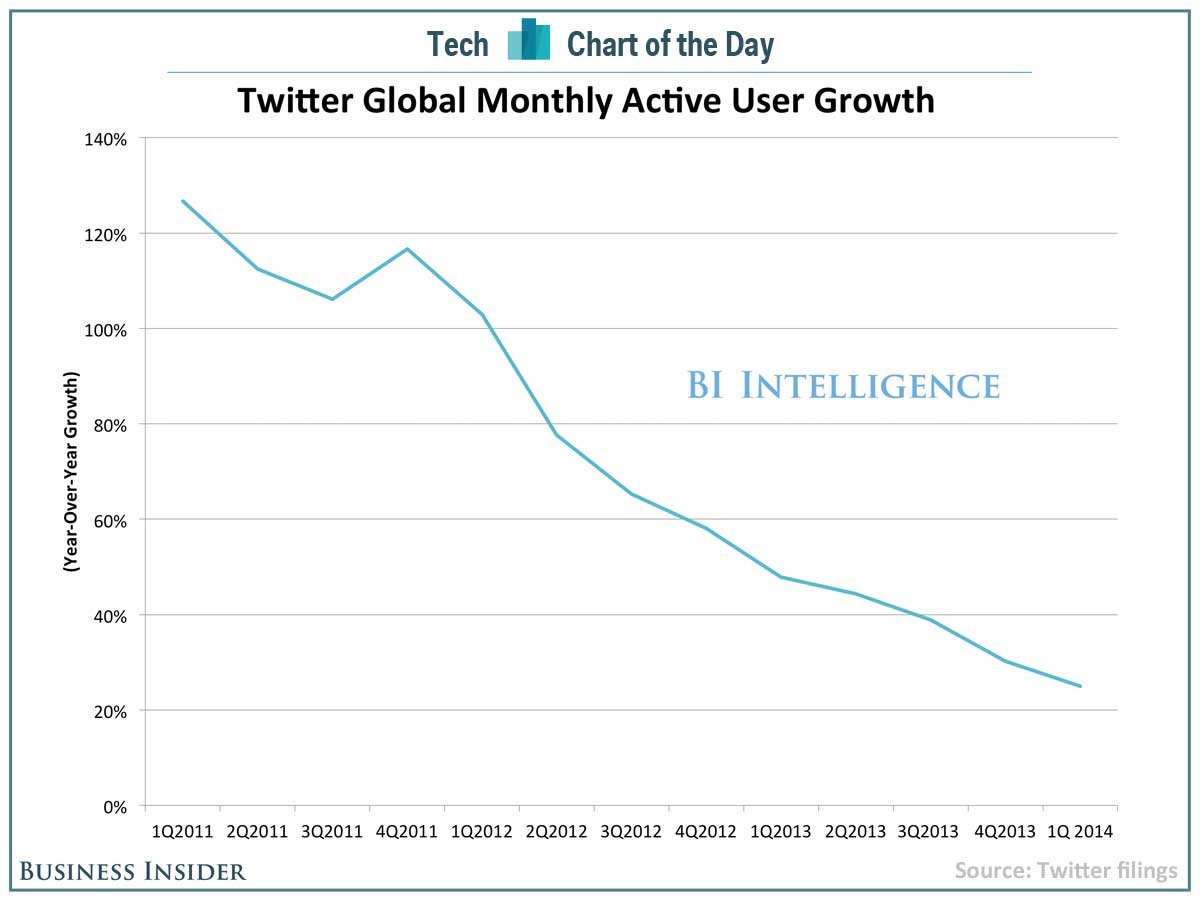

But, the chart of the day comes from BUSINESS INSIDER:

Provided by BUSINESS INSIDER

Yep... Active user growth is down to 5.8% quarter over quarter, down from over 120%. Can you imagine if that turns negative?... yikes.

For the record my position is:

Long CS 46/48

Long PS 39/37

This is trade analysis, not a recommendation.

Follow @OphirGottlieb

Tweet

Legal Stuff:

Options involve risk. Prior to buying or selling an option, an investor must receive a copy of Characteristics and Risks of Standardized Options. Investors need a broker to trade options, and must meet suitability requirements.

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. I am not engaged in rendering any legal or professional services by placing these general informational materials on this website.

I specifically disclaim any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

I make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that I endorse, sponsor, promote or am affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

you sold wings to lower the debit?

ReplyDeleteExactly. ..

DeleteGood Luck on your trade Ophir. But how do you evaluate of Twitter longer term? Do you see value in the company as a medium to reach potential clients/customers or are you strictly reading the options market shorter term?

ReplyDeleteNot surprised at the decreasing active user base. The app is a very simple app and not very useful. You cannot even search through the tweets you receive. I cannot believe there are not so many other tweet apps. There will always be active users like you who produce content, but you don't know how many actually get read. I think this is long put worthy stock.

ReplyDelete