| Tweet | Follow @OphirGottlieb |  |  |

MA is trading $87.64, up 0.2% small with IV30™ up 6.0%. The Symbol Summary is included below.

Provided by Livevol

Conclusion

MA is breaking all-time highs in stock price today, hitting over $100B in market cap and now trading at a price to earnings ratio of over 30. Things look good at MA, but one phenomenon in particular makes this new high feel a little bit... artificial?

I wrote a full story that covers more than just MA on MarketWatch. You can read that article here:

5 charts show how stock repurchases boost prices

The visualization below takes all North American companies with market caps above $50B and charts market cap on the x-axis and stock repurchases over total assets on the y-axis.

What do ya know, MA has the second largest stock buybacks of this group, and other than MON, it's on a totally different island (number three is APPL... by the way).

Provided by Capital Market Laboratories

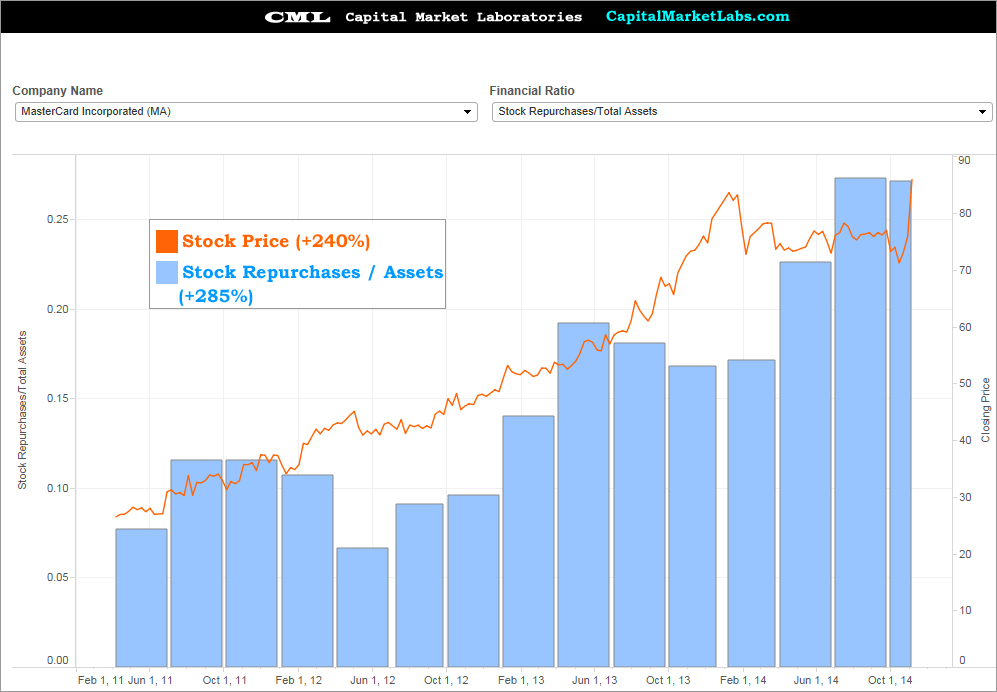

Stock Price vs. Stock Repurchases

Is there a correlation between the stock price and the stock repurchases?,,, Actually, yes, a striking gone. MA stock has risen ~250% since 2011 ans stock repurchases have increased ~285%. A correlation does not mean causality... but it does mean... well, a correlation.

Provided by Capital Market Laboratories

Finally, the Options Tab is included below.

Provided by Livevol

Using the at-the-money (ATM) straddle we can see that the option market reflects a price range of [$85,$91] by the end of trading on Dec. 19th.

- If you believe the stock will be outside that range on expiry or any date before then, then you think the volatility is too low.

- If you believe that range is too wide, and that the stock will definitively be in that range on expiration, then you think volatility is too high.

- If you're not sure, and can make an argument for either case, then you think volatility is priced just about right.

This is trade analysis, not a recommendation.

Follow @OphirGottlieb

Tweet

Legal Stuff:

Options involve risk. Prior to buying or selling an option, an investor must receive a copy of Characteristics and Risks of Standardized Options. Investors need a broker to trade options, and must meet suitability requirements.

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. I am not engaged in rendering any legal or professional services by placing these general informational materials on this website.

I specifically disclaim any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

I make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that I endorse, sponsor, promote or am affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

I would like to see the same story done for $MON

ReplyDelete